By including Viva Salud in your will, you are continuing your commitment and support for the struggle for the right to health and social justice, even when you are no longer with us.

Why ?

- A duo bequest allows you to reduce inheritance tax or death duties for your heirs.

- You’ll receive personalised advice and all formalities will be handled professionally.

How does the duo legacy work?

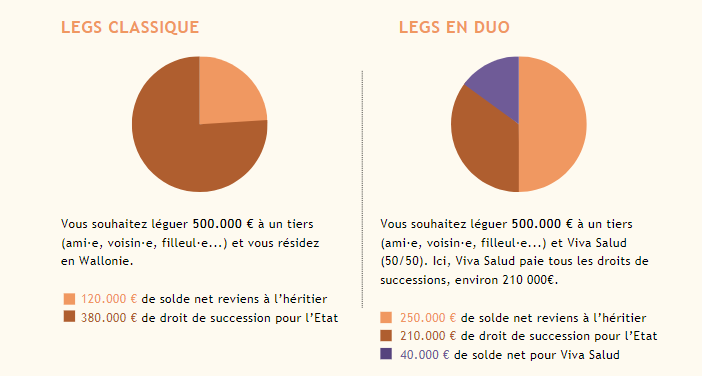

The duo legacy allows you to bequeath your assets to a person who is not in your direct line (children, grandchildren, parents and grandparents) as well as to an association. This formula allows the heir to avoid paying inheritance tax, which is very high if you are not in your direct line (up to 80% in the Brussels-Capital region and 55% in Wallonia).

Inheritance tax rates are lower for associations: 0% (in the Flemish region), 7% (in the Walloon region) or 25% (in the Brussels-Capital region).

By making a duo legacy, the association will be responsible for paying all inheritance tax. This formula is often very advantageous for your third-party heir.

In the Brussels-Capital Region and Wallonia :

If you have direct successors

Your heirs (spouse, legal cohabitant, children, grandchildren, parents) automatically receive part of your inheritance. This amount is determined by law. But you can also choose to leave part of your inheritance to Viva Salud.

If you have no direct successor

If you have no successor, you can include Viva Salud in your will by means of a simple bequest. You can also leave part of your legacy to a friend, nephew or niece… and another part to Viva Salud. If this is not an ordinary bequest, Viva Salud will have to pay all inheritance tax.

In Flanders

Since 1 July 2021, duo legacies are no longer applicable in Flanders. However, it is now possible to leave part of an inheritance to a friend at the lowest rate (3% instead of 25%), up to a maximum of 15,000 euros. The friend will save a maximum of €3,000.

Bequeathing your assets to a good cause will also be very attractive from a tax point of view, as the rate of inheritance tax will be reduced to 0%.

Do you have any questions?

If you have specific questions about legacies or would like to receive a detailed brochure, please fill in this form or contact our Legacy Manager on 02 209 23 65. We will deal with your request as quickly as possible, in complete confidentiality.